By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In our April 2021 Letter to Investors we review how equities moved sharply higher during the month, along with commodity prices, and ask will inflation be next?

Dear Fellow Investors,

Welcome to the April Ophir Letter to Investors – thank you for investing alongside us for the long term.

Equities and commodities roar, inflation next?

For the first quarter of this year, investors have been fretting about bond yields, which have been rising higher on the back of better economic growth, inflation expectations and positive vaccine news.

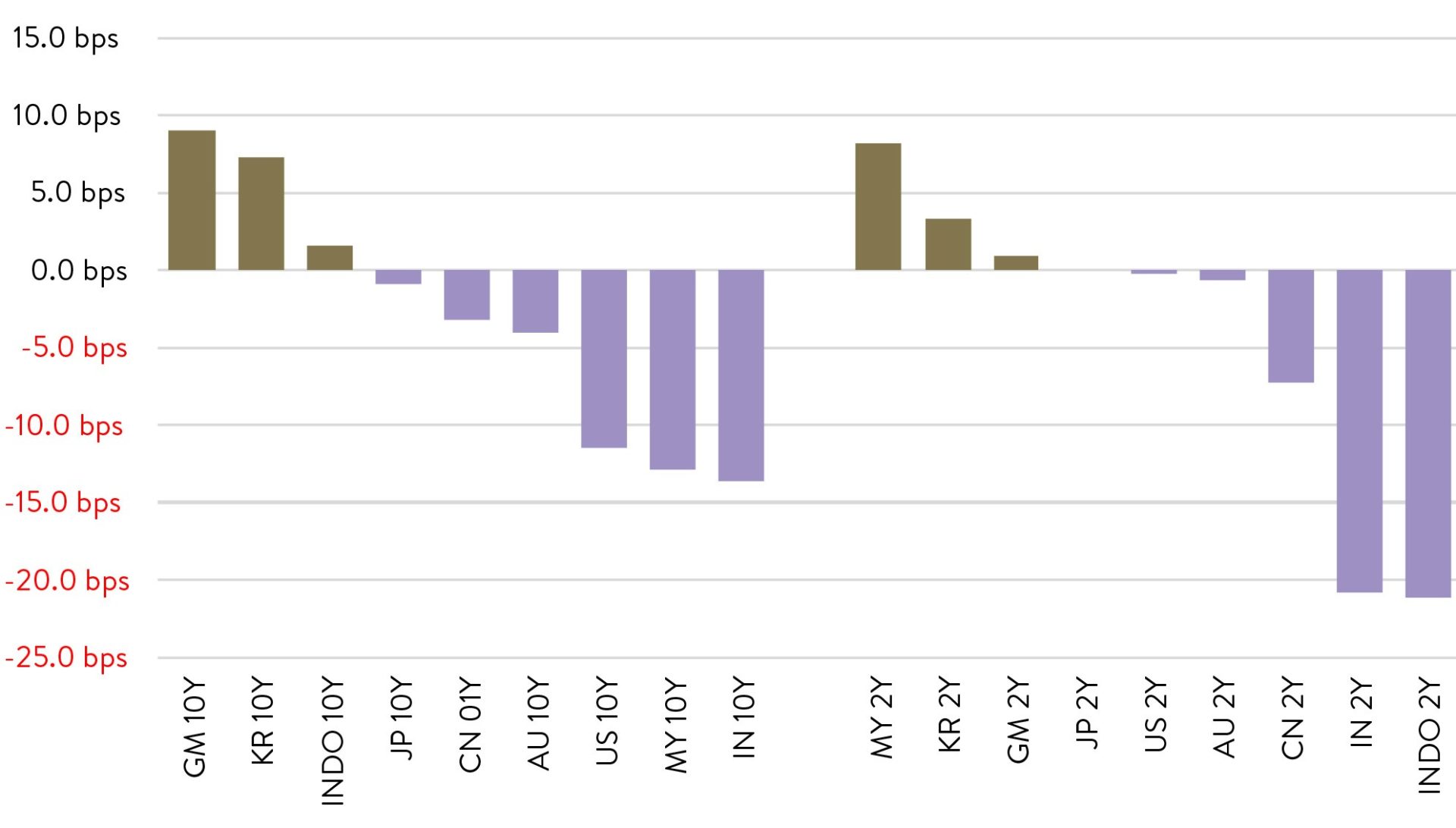

In April, however, bond yields took a much-needed breather. Ten-year government bond yields fell in the US, Australia and Japan, whilst 2-year yields also edged down (see chart below).

Key Bond Yields | 1-Month

Source: J.P. Morgan estimates, Bloomberg Finance L.P.

But this breather is more likely a case of a mid-race pit stop, rather than the end of the journey higher for these ‘risk-free’ rates, particularly as the spectre of inflation emerges, which is likely to see yields rise higher.

Warren Buffett, at the recent Berkshire Hathaway AGM, noted “we are seeing very substantial inflation” in their operating companies.

The Ophir Opportunities Fund returned +8.5% net of fees in April, outperforming its benchmark which returned +5.0% and has delivered investors +25.5% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned +6.7% net of fees in April, outperforming its benchmark which returned +5.1% and has delivered investors +19.5% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +9.8% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities Fund returned +4.7% net of fees in April, outperforming its benchmark which returned +2.8% and has delivered investors +44.4% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

In this letter, we take a close look at whether these early warning signs of inflation are likely to be temporary or something more permanent and dangerous that could derail the stunning rebound in equities since the Covid-19 crash. And we look at which particular type of companies are best placed to protect investors’ portfolios if inflation does rear its head.

April’s bond breather boost

For April, at least, the bond yield breather was enough to have equities investors focus back on fundamentals such as the vaccine and the recovery in corporate earnings that has been boosted by monetary and fiscal policy.

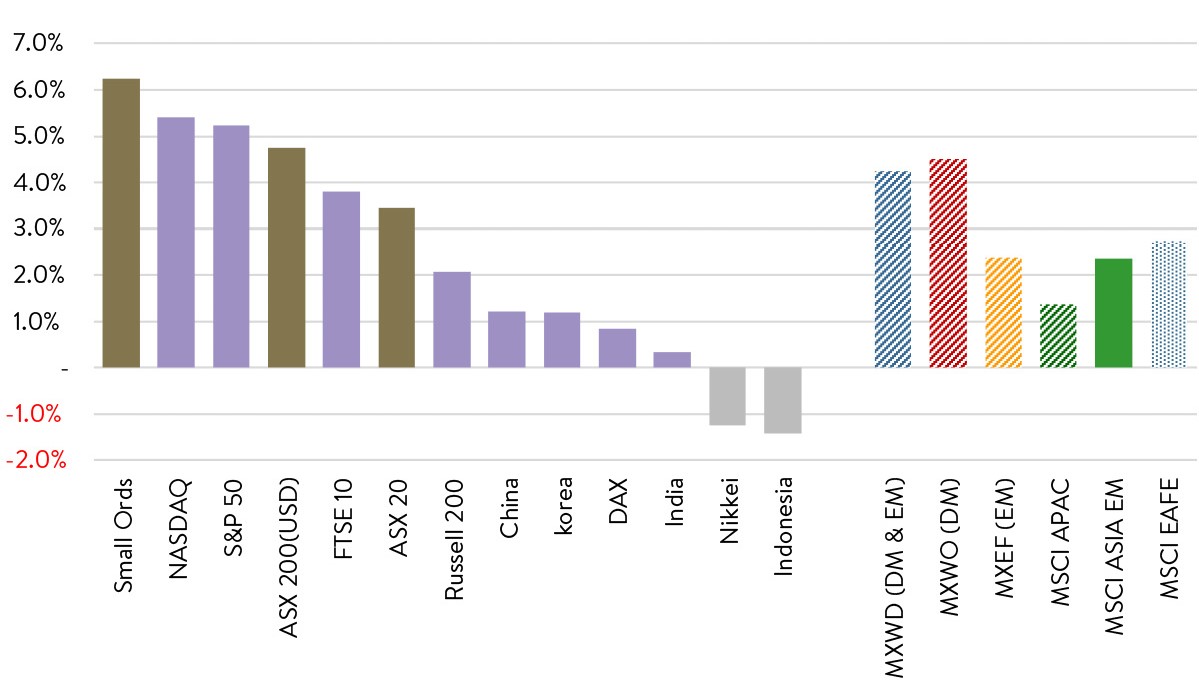

Almost all major share markets posted well-above-average monthly returns in April, including the tech-heavy NASDAQ.

Most of these gains, though, occurred earlier on in the month. But then later in the month fears grew about the ‘fourth wave’ of COVID cases globally, and in particular its tragic and rampant spread through India.

Global Markets | 1-Month

Source: J.P. Morgan calculations, Bloomberg Finance L.P.

The retreat in bond yields triggered a rotation from ‘value’ – which had benefited from rising yields and a rotation away from ‘growth’ in the first three months of 2021 – back into ‘growth’ and ‘quality’ style companies. This growth rotation was more pronounced in the US with the S&P500 Growth index up 6.9% versus its Value counterpart at 3.7%, but was still seen in Australia (3.7% v 3.3%).

Aussie equities shine

But as you can see above, the Australian market also posted strong returns, particularly Aussie small caps, on the back of strong commodity prices.

Domestically, share market returns in the month were led by IT (+9.7%) and Materials (+6.8%), with the latter contributing most to overall market returns, given Australia’s significant weighting to the sector.

Materials – which incorporates miners — ripped right across the market cap spectrum in Australia in April, particularly companies exposed to a 14% and 12.5% rise in iron ore and copper prices respectively during the month.

In the mid and small cap space we invest in, for Australia, five of the top 10 companies in ‘mids’, and seven of the top 10 in ‘smalls’, were from the Materials sector.

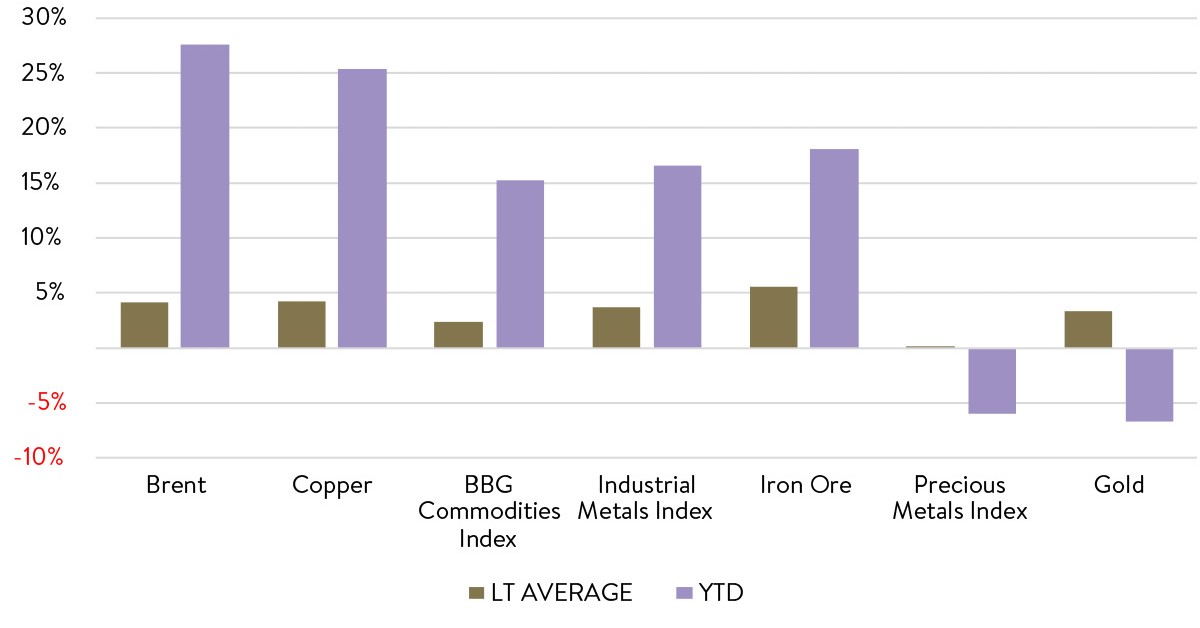

This has been a common theme of late where a number of key commodities have started the year off with a bang, posting well-above-average gains in the first four months of the year (see chart below).

Commodities: Jan-April long-term average performance vs YTD performance

Source: J.P. Morgan calculations, Bloomberg Finance L.P

The upswing in the economic cycle, which has benefited other cyclical sectors of global share markets more generally, has increased demand for these commodities.

This may continue in the near term, but the global growth impulse is likely nearing its maximum so shouldn’t be relied on for multi-year gains in commodities.

A stunning and justified market recovery

With the end of the first four months of 2021 behind us, it’s a good time to step back and reflect on the performance of equities since Covid-19 hit.

Equity markets used to take years, sometimes decades, to recover back to their prior peak after suffering a bear-market decline. However, after last year’s 33% meltdown, the Australian equity market is already pressing record highs, up about 7% so far this year and more than 47% from its bear-market low of March 2020.

This stunning bounce has been a product of unprecedented monetary and fiscal stimulus. Around the world, central banks have squashed interest rates toward zero and been engaging in bold quantitative easing programs. At the same time, governments have injected trillions of dollars into their economies, hoping that people can be kept in jobs and continue spending.

When we look at the moving parts, the equity markets rebound seems justified. Firstly, the economic recovery in Australia has surprised almost everyone in its strength. The RBA now expects the domestic economy to grow by 4.75% in 2021 and 3.5% in 2022, a significant upgrade versus earlier fears.

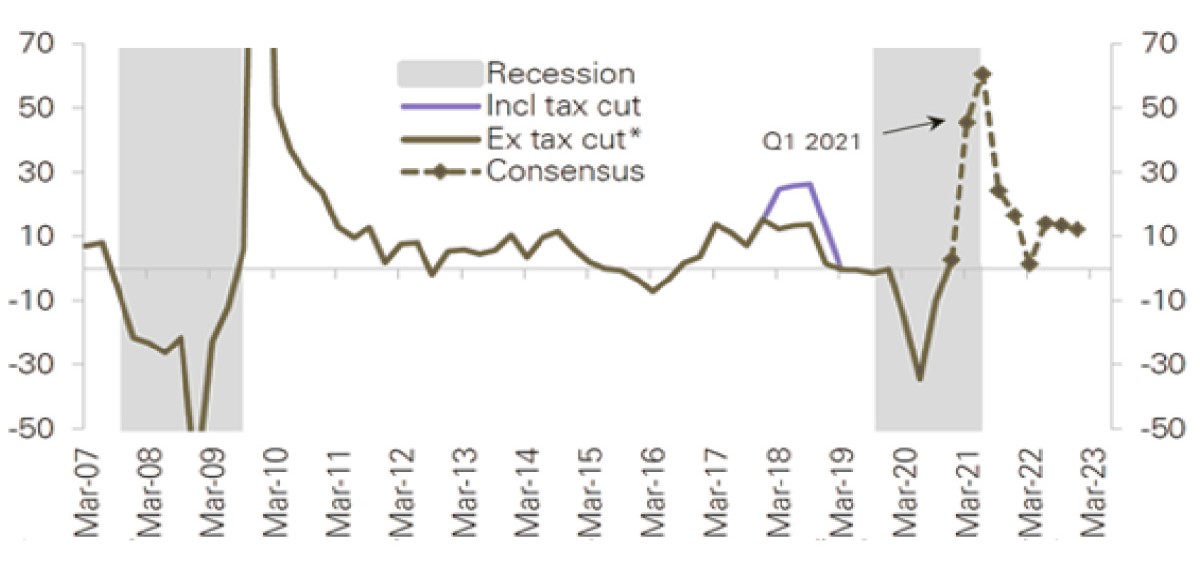

A sharp recovery in corporate earnings has paralleled this economic health.

Australian company profits fell sharply last year, hitting a low point in December. Since then, the trajectories have been notable, with aggregate earnings already rising by around 10% and expected to be 25% up from their trough by year-end.

Data coming in from US companies is even more impressive, with more than 80% of companies beating earnings expectations in the most recent reporting season. In aggregate, these companies are beating earnings by 25%, with an outsized contribution from financials. The brokers whose forecasts create the consensus earnings numbers have been clearly surprised by the confidence of the global consumer.

US Equity Market Earnings Growth (% yoy)

Source: Deutsche Bank

But will inflation derail this picture?

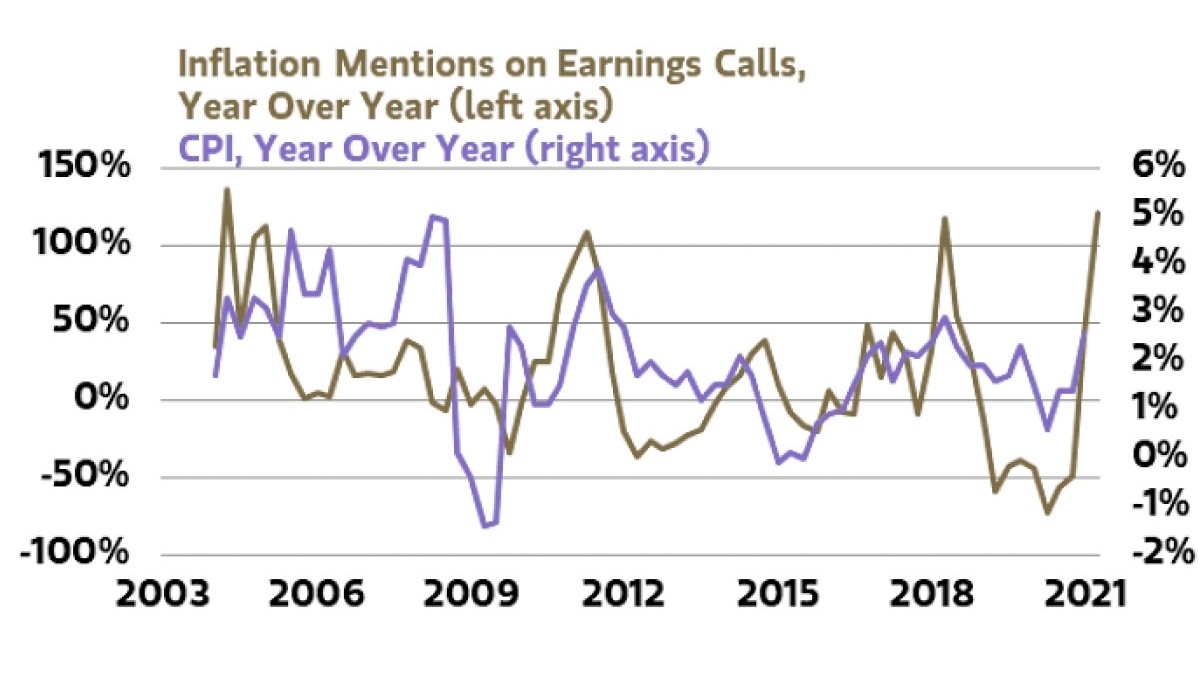

But as we highlighted last month, the big risk for equity markets is a sustained bout of inflation that may trigger sharply and unexpectedly higher interest rates. As mentioned, even Warren Buffett at Berkshire Hathaway’s recent AGM noted “we are seeing very substantial inflation” in their operating companies. This echoes what other business operators in the US have been saying on their earnings calls of late (see chart below).

Companies are talking about inflation risk

Source: Bloomberg as of 31 March 2021

A key question for investors and markets is: will this be a transitory spike as inflation numbers rebound from Covid-depressed levels from this time last year? Or will a rise in inflation be more enduring, and therefore a greater threat to equities?

We, along with most central banks, suspect it will be temporary as activity normalises post vaccine rollouts and economic reopening. But that is by no means certain.

Some economists fear there has been too much fiscal stimulus this time around by governments. They argue that excess stimulus by governments during COVID (beyond what is needed to make up for what otherwise would have been the demand lost due to COVID), along with a mammoth infrastructure bill in the US, will stoke sustained inflation, leading to higher interest rates and ultimately the tanking of share markets.

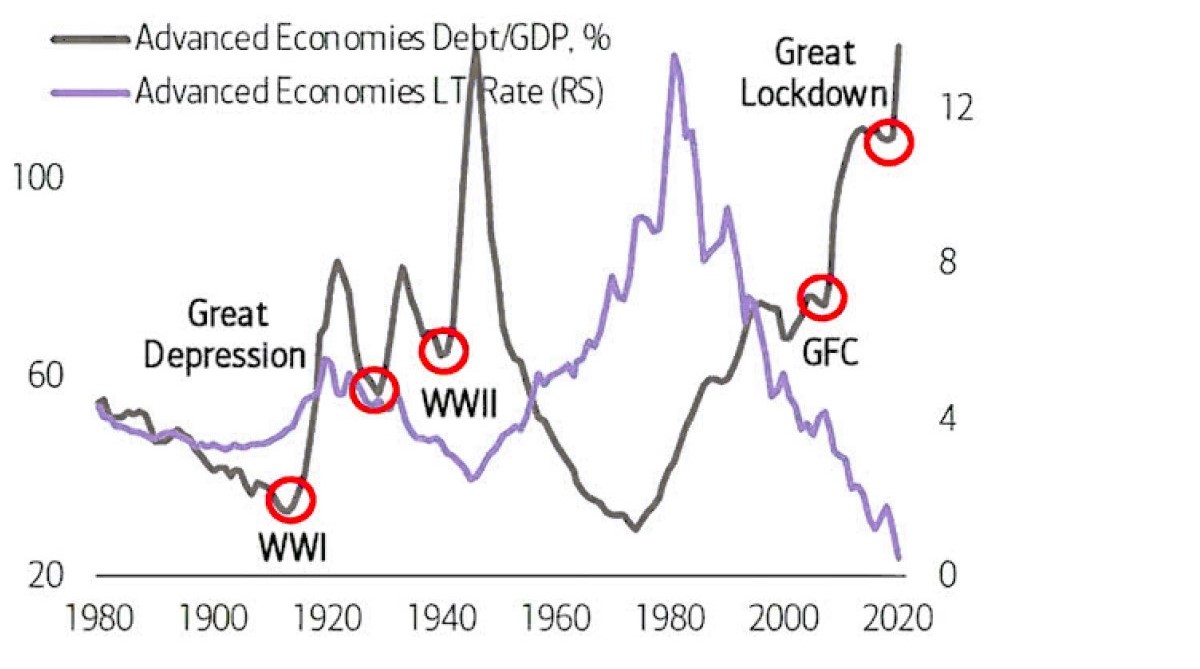

In the chart below you can see that government debt levels in advanced economies are at record WW2 proportions, whilst borrowing rates on that debt are at all-time lows.

Debt stoking inflation that causes higher yields

Public debt and bond yields in advanced economies, 1800-2020 (%GDP LHS, %RHS)

Source: IMF, Historical Public Debt Database, IMF, World Economic outlook database; JST Macro History database, Maddison Database Project; Thomson Reuters Datastream, Global Financial Data and IMF staff calculations.

Note: The public-debt-to-GDP and long-term interest rates series for advanced economies are based on a constant sample of 20 countries, weighted by GDP in purchasing power parity terms. WWI = World War 1; WWII = World War 2.

How will Governments dig out of debt?

Now, there are three main ways for Governments to reduce the debt load which is easily remembered by the acronym of ‘D.I.G.’ (as in DIG-ing your way out of debt!):

- Default: not particularly attractive or reputation-enhancing, and really a last resort – though the list of offending countries who have done this historically is long.

- Inflate: The debt costs are generally fixed in nominal terms, so inflation reduces their value in real terms. Basically, inflation makes money lose value, so borrowers – in this case the Government – will be paying back less in the future. At the same time, inflation can increase the Government tax take.

- Grow: Higher economic growth (through productivity and population growth) will result in higher tax revenues to pay off debt or to reduce the relative size of the stock of debt.

Option 1 is not currently necessary given the low cost of debt for advanced economies, whilst option 3 is more challenging given lower birth rates and some evidence that the best of advanced economy productivity growth may be behind it.

That leaves option 2. Whilst lowering the real value of public debt might not be the primary aim of central banks in trying to stoke some inflation currently, they would likely see it as a beneficial side effect.

This will be a delicate balancing act for governments and central banks to navigate. They will be hoping to produce some modest inflation, with only modest rises in interest rates required in response.

However, if they have provided too much stimulus and are too late to the inflation-fighting game, investors beware. You better have a portfolio of companies at the ready with market pricing power – and conservative levels of debt!

It will be those businesses with pricing power, who can pass on higher input costs to their customers, who will be able to maintain margins and weather this period best.

A great example here in our High Conviction Fund is Seek (ASX:SEK), the leading job portal provider in Australia with large markets share in the Asia Pacific region. As a company that is benefiting from the re-opening of economies it has also been able to push through prices rises.

Whilst we don’t think the inflation genie is out of the bottle, its chances are increasing. A prudent review by investors of portfolio positioning for this risk is in order.

Too far too fast?

Of course, aside from inflation, the other factor that could derail the remarkable post-Covid crash recovery in equities is valuation.

As should be expected, stock prices have moved up in advance of the earnings recovery. But the gains have resulted in equity valuations which now look concerning in some regions.

A key measure is the cyclically adjusted price-to-earnings (CAPE) ratio made famous by Robert Shiller. For US stocks, this is now at a level that has only been exceeded once before, in the tech bubble. Traditional PE measures also show US stock valuations uncomfortably above the long-term average. In both instances, the stretched ratios we see reflect the premium valuations which today’s tech giants are awarded.

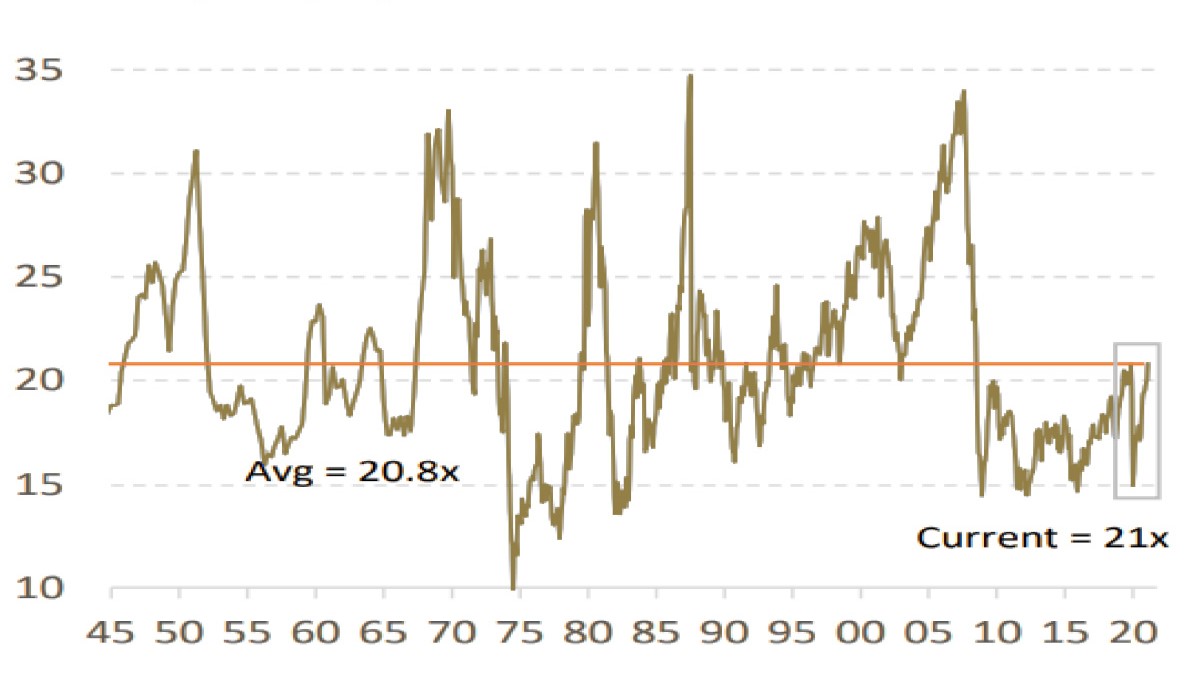

By contrast, the weighting of technology shares on the Australian equity market is far lower than in the US. Market multiples recognise this, with CAPE in Australia sitting at its long-term average. Admittedly other PE measures do show Australian stocks at the upper end of their range, but this will ease over the next few quarters as earnings come through.

ASX 200* Cyclically adjusted PE (Cape)

Source: MST Marquee, *or equivalent

For investors, the period of peak cycle growth we are now in creates some discomfort. It could mean overheating (which would trigger inflation and a response in terms of tighter monetary policy), or it could mean that economic growth can now only slow down or even go into reverse.

Similarly, the rate at which profits are rising has probably peaked, meaning earnings growth will soon start moderating.

However, a collapse or reversal in earnings does not seem likely given that central banks have effectively committed themselves to maintaining low rates. In addition, governments seem willing to do whatever it takes to avoid a hard economic landing.

The re-rating which equities have seen combined with already peak earnings mean that many of the easiest gains have now passed. There are still opportunities in stocks, and capturing these investors needs to shift attention to the pockets of the market that have been neglected. A big part of this will be through rotating into cyclical and value sectors, which are levered to the economic reopening. Financials and energy stand out.

Meanwhile, technology companies, which have been a core part of portfolio performance throughout the pandemic, now require a more selective approach. For example, structural themes like fintech and Greentech still have huge potential.

Equity market investors who held their nerve over the last year have been rewarded. As we advance, stock returns will not be as impressive, but they still offer the most compelling investment case. But as recent months have shown, the COVID-19 recovery will continue to bring sharp rotations within the market. It follows that we should expect volatility, and therefore a disciplined investment approach is still essential.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.