We review prior elections to understand whether history can give us additional insight into where markets may be headed post the election.

On Saturday the 18th of May 2019 voters will elect the members of the 46th Parliament of Australia and the next Federal Government will be formed. Like many investors, at Ophir we have analysed the policies of both major parties to understand the impact they may have on markets.

As part of our analysis we also reviewed prior elections to understand whether history can give us additional insight into where markets may be headed post the election.

For equity investors elections are viewed with a certain degree of trepidation. Although the Australian political system is considered robust and stable, new governments inevitably bring about change. In most instances the policies which new government introduce are forgotten by most within a short period of time and business continues on as is.

But on occasions a new government can attempt radical reform that may require a total reassessment of the opportunities and risks which many listed companies face. A clear example of significant reform was John Howard’s introduction of GST post his 1998 election win.

At this coming election the possibility we will see a new political party take power in Canberra means extra attention is being paid to the Opposition’s policy proposals.

Although the outcome is not certain given the current Coalition government won the last election with just a one seat majority in the lower house, the ALP only needs a minor swing from the electorate to gain power.

When we take into account the polls which consistently show Labor holds a lead on a two party preferred basis it suggests the Coalition may lose this election and Labor gain back government.

Do Elections Matter to Investors?

So are elections events which stock market investors should be concerned about? And do elections alter the fortunes of equities when the governing party changes?

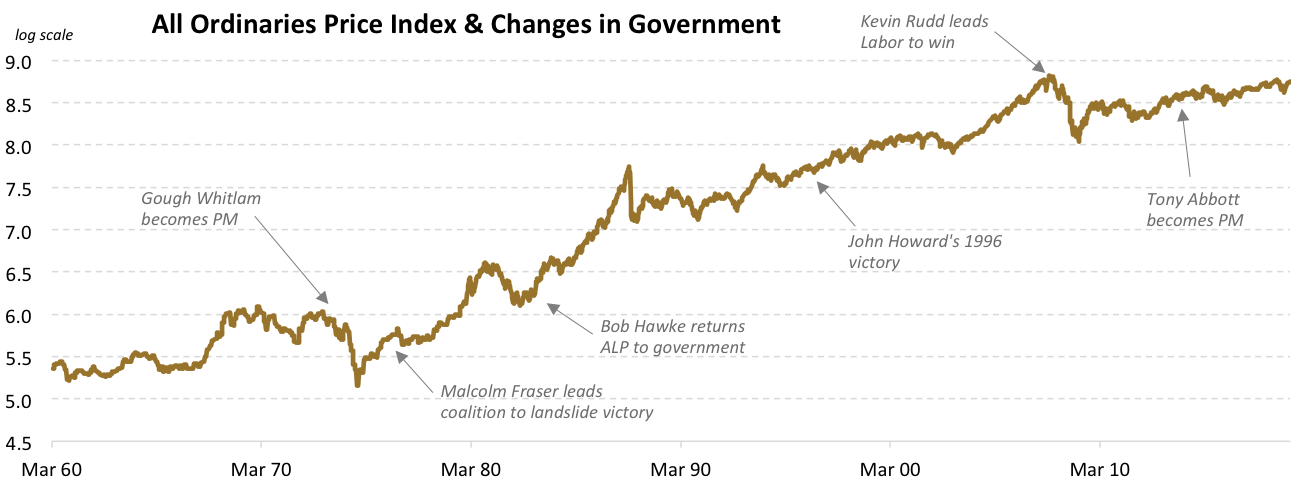

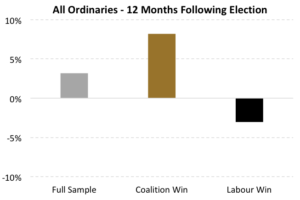

To answer these questions we studied how the All Ordinaries index traded through each Federal Election since 1970. This period covers 22 elections with the Coalition winning thirteen and Labor nine.

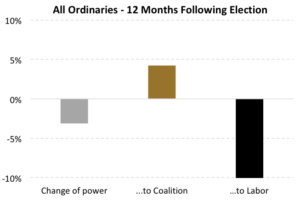

On average we found equities rose by about 3% in the twelve months following an election. But when we narrow down to elections where the government changed hands we find stocks actually suffered slight falls.

More interesting are the differences seen when we split victories between parties. The All Ordinaries index historically generated strong returns in the year following a Coalition win but in contrast ALP victories have on average seen shares fall.

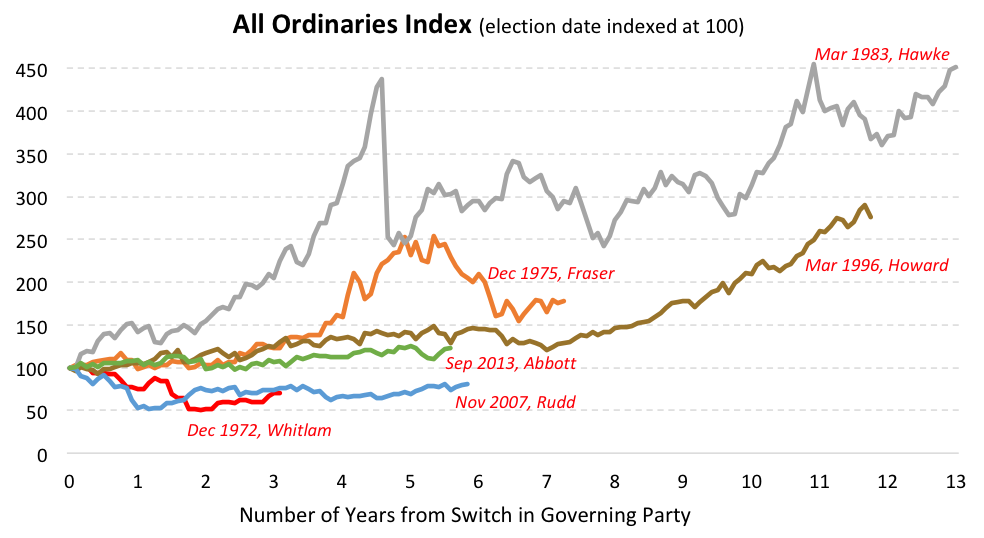

From the elections studied there are some dramatic outcomes. For example:

- A quadrupling in the share-market through the first 4 years of the Hawke government.

- The All Ordinaries halving within 12 months of Kevin Rudd becoming PM.

- Spectacular returns through the first 5 years of Malcom Fraser’s term, only for most of these gains to fall back during the following 18 months.

Taking a step back we point out these different governments spanned across five decades. During this time we have seen significant structural changes, not least the marked step down in inflation rates. The composition of the equity market also radically altered with resource stocks comprising more than half the market through the 1970’s and 1980’s, but less than 20% now.

Global Themes Often Dominate

Of the six instances we measured where the opposition won an election on only two occasions did that government’s term fail to deliver stock market gains (see chart above). The first of those was Gough Whitlam’s 1972 victory where the All Ordinaries fell by 30% through its three year term. Kevin Rudd’s win in 2007 proved almost as disappointing with Australian shares 20% lower when he left office in 2013 versus where they sat at the start of his term.

It would be tempting to conclude a transition of power to the ALP is bad for equities given both instances where equities declined over the term of a new government were off Labor victories. In reality it’s not that simple. For Kevin Rudd it was a financial crisis of global scale which weighed on equities through his term while Gough Whitlam’s government had similar poor luck via the global oil price shock of 1973/4.

What Now?

Economic management has shaped up to be a core battle over which this election will be fought. The current PM, Scott Morrison, recently brought forward the budget to provide positive momentum behind his campaign. In his budget $302bn in tax relief has been promised over the next decade and $100bn in infrastructure spending. The Labor party matched the coalition in reducing tax but is directing these cuts towards lower income earners.

However where the ALP really distinguishes is by plans to phase out tax breaks for property and stock market investors. By eliminating these programs Opposition leader Bill Shorten intends to significantly step up investment on health and education.

It is fair to say Labor’s ambitious plans are politically risky. To a generation of Australian investors negative gearing and franking credits have been crucial building blocks in managing wealth. Further, Labor’s ‘living wage’ policy may negatively affect Australian retailers at a time when the sector is already facing multiple headwinds.

If the ALP does gain government the implementation of these policies could prove a tough test for equities to perform. At Ophir we have been particularly cautious with retailers with high employee expense to revenue ratios and low margins.